Portfolio Finance

-

$0.8b+$0b+Committed capital

-

6–80–0Investments per year

-

210+0+Investments

-

$18b+$0b+Commitments to GP-centered investments

As a longstanding leader in structuring customized liquidity solutions, we can provide a broad range of NAV- and other asset-based financing options for owners and managers of private equity assets.

Focus on capital preservation

We seek to construct customized capital solutions that are designed to deliver a consistent fixed income return with an emphasis on downside protection.

Platform advantages

Our collaborative GP-centric approach leverages our Primary Fund Investment and Co-investment capabilities to deliver real sourcing and information advantages from a universe of more than 350 relationship GPs globally. Integrating our portfolio financing solutions with our extensive capabilities in the secondary market, we believe we have created a differentiated one-stop solution provider for the private equity industry.

Partner of choice for GPs

We endeavor to offer the broadest range of innovative solutions with a long-term partnership approach that resonates in the market. As a longstanding leader in the market, we can be trusted to address all of their capital and liquidity needs from credit to equity.

As a result of our longstanding reputation, we believe that we often receive the first call or the last look on opportunities with leading GPs.

Innovative structuring

Our approach is to design each transaction to the specific needs of our partners and by deploying custom-designed preferred and structured equity solutions as well as more traditional debt offerings.

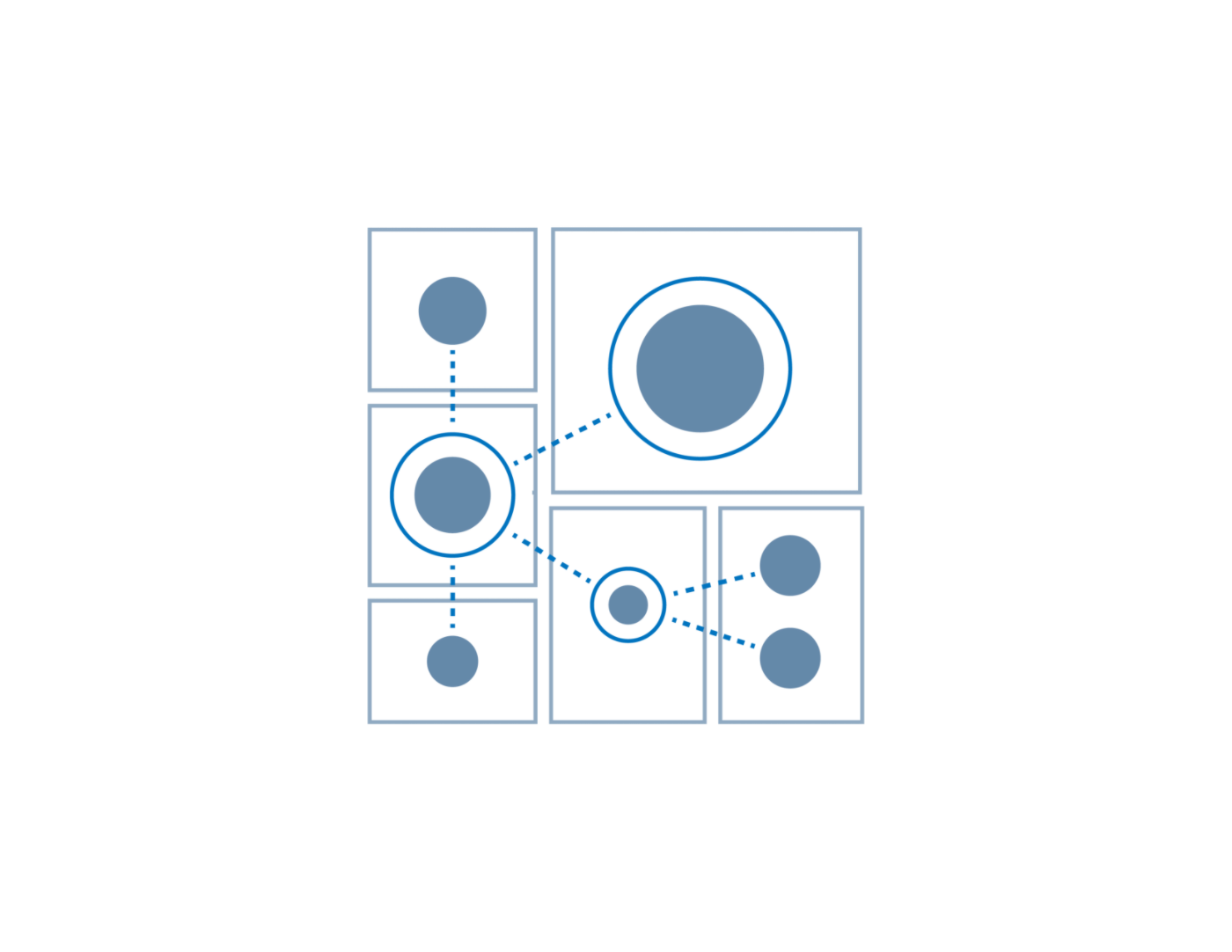

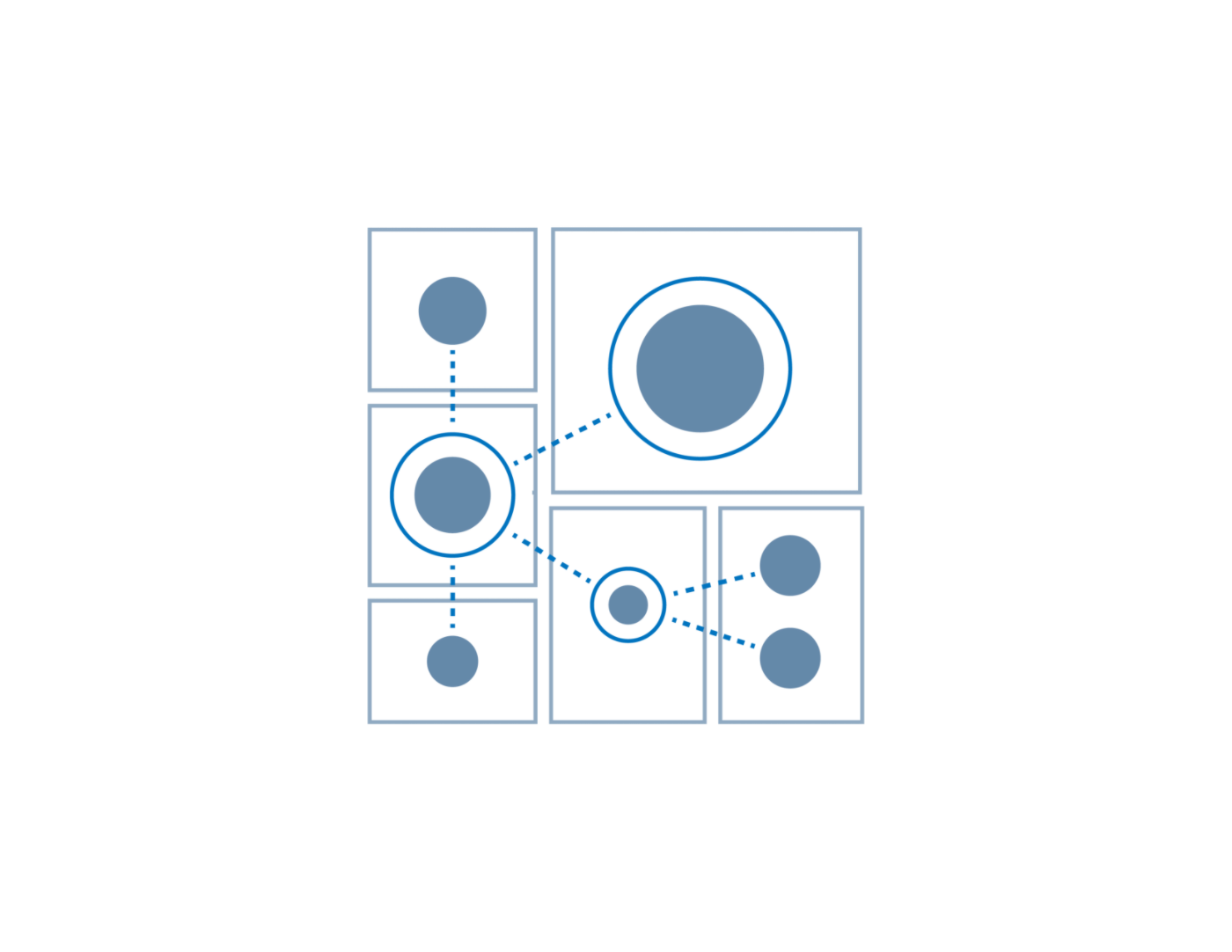

A broad menu of solutions

AlpInvest’s flexible approach to structuring transactions and ability to deploy innovative solutions has resulted in an increasingly broad set of alternatives for owners and managers of private equity assets.

Across our Secondary and Portfolio Finance platform, our capital solutions range from preferred equity financings for private equity funds and management companies to continuation funds and fund recapitalizations.

A highly experienced partner

Having executed over 210 Secondary and Portfolio Finance transactions since 2002, we have significant experience helping owners and managers of private equity assets navigate a wide range of situations. We provide professional and efficient execution, backed by our deep expertise and our reputation as a leader in the industry. We believe we are viewed as a trusted partner that can be counted on to ensure the highest level of discretion.

Meet the team

The Secondary and Portfolio Finance team spans the globe and boasts decades of investment expertise and experience through market cycles.

Secondary and Portfolio Finance professionals

Office locations globally with Secondary and Portfolio Finance professionals

Years of combined private equity experience